Introduction:

In the dynamic realm of finance, the emergence of public crypto companies has sparked a new wave of interest and investment. These companies, which are publicly listed and traded, offer investors a unique opportunity to participate in the growth and evolution of the crypto industry. From established players to innovative newcomers, the landscape of public crypto companies is diverse and ripe with potential. In this article, we delve into the intricacies of this burgeoning sector, exploring key trends, notable players, and investment considerations.

The Rise of Publicly Traded Crypto Companies:

The advent of public crypto companies represents a significant milestone in the maturation of the cryptocurrency ecosystem. Historically, the crypto market has been dominated by decentralized projects and privately held startups. However, as interest in digital assets continues to grow, an increasing number of companies are seeking to capitalize on this trend by going public. This shift not only provides these companies with access to public capital markets but also signals a broader acceptance of cryptocurrencies within traditional financial circles.

Diverse Investment Opportunities:

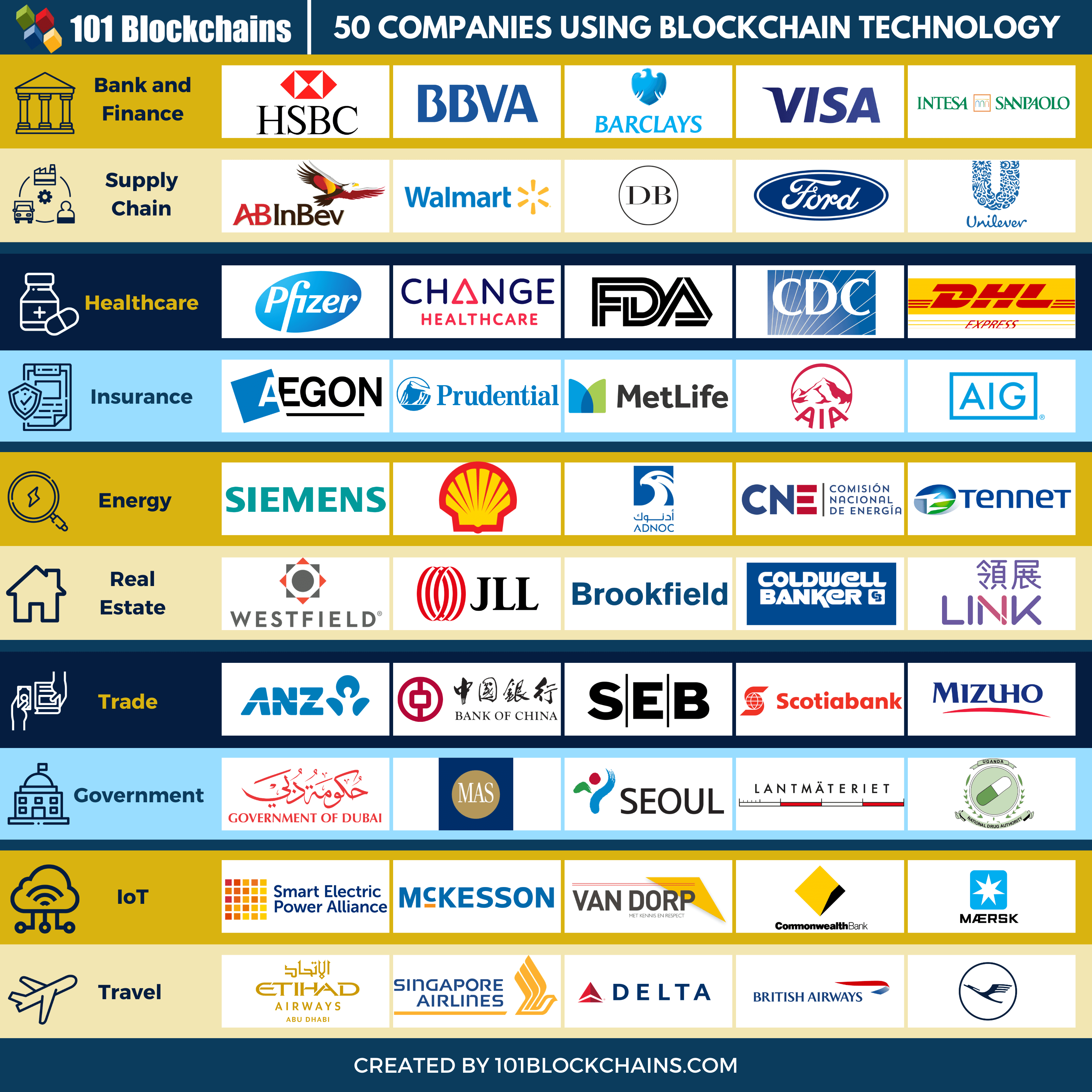

One of the most compelling aspects of public crypto companies is the diverse range of investment opportunities they offer. From cryptocurrency exchanges and mining operations to blockchain technology providers and digital asset management firms, there is no shortage of options for investors looking to gain exposure to the crypto market. Whether you’re bullish on Bitcoin, Ethereum, or emerging altcoins, there are public companies catering to virtually every niche and strategy.

Navigating Regulatory Challenges:

While the growth of public crypto companies has been met with enthusiasm from investors, it has also brought about regulatory challenges. The regulatory landscape surrounding cryptocurrencies and blockchain technology remains complex and rapidly evolving, with regulatory bodies around the world grappling with how best to oversee this nascent industry. For public crypto companies, navigating this regulatory uncertainty is crucial, as compliance failures can have serious consequences for both investors and the companies themselves.

Transparency and Disclosure:

Transparency and disclosure are paramount in the world of public markets, and public crypto companies are no exception. Investors rely on accurate and timely information to make informed decisions about where to allocate their capital. As such, public crypto companies are held to high standards of disclosure, with regulatory requirements mandating the release of financial reports, corporate governance practices, and other material information. For investors, this transparency provides greater visibility into the operations and financial health of these companies.

Market Volatility and Risk Management:

The crypto market is known for its volatility, with prices often experiencing rapid fluctuations driven by a variety of factors, including market sentiment, regulatory developments, and technological advancements. For public crypto companies, managing this volatility is a key challenge. While volatility can present opportunities for profit, it also introduces risks, particularly for companies with significant exposure to digital assets. As such, risk management strategies are essential for public crypto companies seeking to safeguard their capital and preserve shareholder value.

Innovation and Technological Advancement:

Public crypto companies are at the forefront of innovation, driving advancements in blockchain technology and digital asset management. From developing cutting-edge trading platforms to pioneering new consensus mechanisms, these companies are pushing the boundaries of what’s possible in the world of finance. For investors, this focus on innovation represents an exciting opportunity to participate in the growth of a transformative industry that has the potential to reshape the global economy.

Conclusion:

In conclusion, public crypto companies represent a compelling investment opportunity for those looking to gain exposure to the burgeoning crypto market. With diverse investment options, regulatory challenges, and technological advancements, this sector offers something for investors of all stripes. However, it’s essential to approach investing in public crypto companies with caution, as volatility and regulatory uncertainty can pose significant risks. By staying informed and conducting thorough due diligence, investors can navigate this rapidly evolving landscape and potentially profit from the growth of the crypto industry. Read more about public crypto companies